Rural renovations: Three features every patient payment portal should have in 2024

For rural hospitals, technology is both an opportunity and a necessity as patient expectations during the billing process quickly change. The good news for providers is that these capabilities have become more affordable and can not only improve the patient experience but also drive faster and more consistent payment resolution.

While rural communities may be geographically isolated, they are no less exposed to digital transformations. The online services patients use in other aspects of their lives are undoubtedly shaping their expectations for their medical billing experience. To meet these expectations and gain efficiencies, here are the top three payment portal features that rural hospitals should have for the year ahead.

|

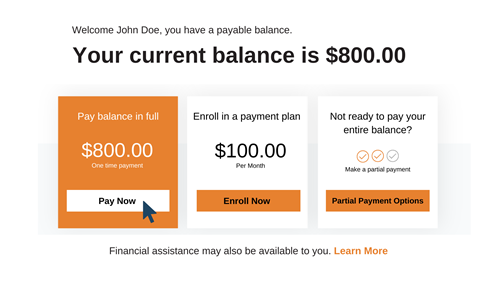

Self-enroll payment arrangements

As self-pay responsibilities increase and high-deductible health plans become more common, patients need flexible payment options. This empowers them to take control of their health care bills, break down payments into manageable chunks, and set up partial payment plans that align with their financial situations.These features have never been more valuable considering more than 55 percent of Americans are enrolled in high-deductible health plans, the highest amount on record, according to a Lending Tree report.

Providers can set the balance increments and timeframes in accordance with their organization’s policies and allow patients to self-enroll in a plan that works for them. This saves the business office time by allowing patients to resolve balances themselves and eliminates unnecessary phone calls to their office.

|

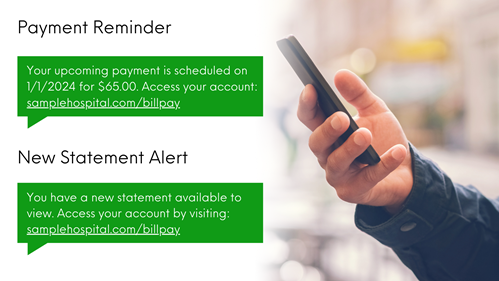

Text and email notifications

The use of text and email notifications within patient payment portals is gaining momentum. In fact, 31 percent of consumers report they pay faster when notified about bills via text, app notification, or email, according to US Bank’s health care payments insights report.The data is clear: Patients are opting for electronic statements more than ever. A J.P. Morgan report on trends in health care payments found that 67 percent of consumers want digital and electronic payment options, such as receiving electronic statements and paying online.

Many patients pay faster when notified of their bill through text or email, not to mention the cost savings providers see from a reduction in paper statements. With a natural adoption of these features by patients, text and email notifications are one of the best steps providers can take to modernize the patient payment experience.

|

Clear statement breakdown

One of the fundamental aspects of an effective patient payment portal is the ability to present patient charges in a clear and detailed manner. Patients deserve to know what services they are being billed for and easily see where those charges originated, such as a physician group, clinic, or hospital. By breaking down these charges, patients can make informed decisions about their financial obligations, leading to faster payment resolution.A patient payment portal should also provide the capability to break down charges by guarantor, offering a granular view of each party's financial obligations. This includes parents responsible for their children's medical bills and individuals acting as guarantors for family members or dependents. This simplifies the billing process, eliminates confusion, and helps patients understand their specific responsibilities.

This not only benefits the patient by providing them with a more transparent billing experience but also reduces the workload on health care providers, who no longer need to field numerous calls seeking clarification on billing details.

A digital renovation

Robust payment portals offer a self-service approach to account resolution that reduces the need for extensive customer service interactions and contributes to a better patient experience. While rural hospitals are faced with slim operating margins, there has never been a more affordable time to implement digital payment and communication features that increase self-pay resolution.You can learn more about digital engagement solutions for rural hospitals by contacting representatives at Magnet Solutions.

NRHA adapted the above piece from Magnet Solutions, a trusted NRHA partner, for publication within the Association’s Rural Health Voices blog.